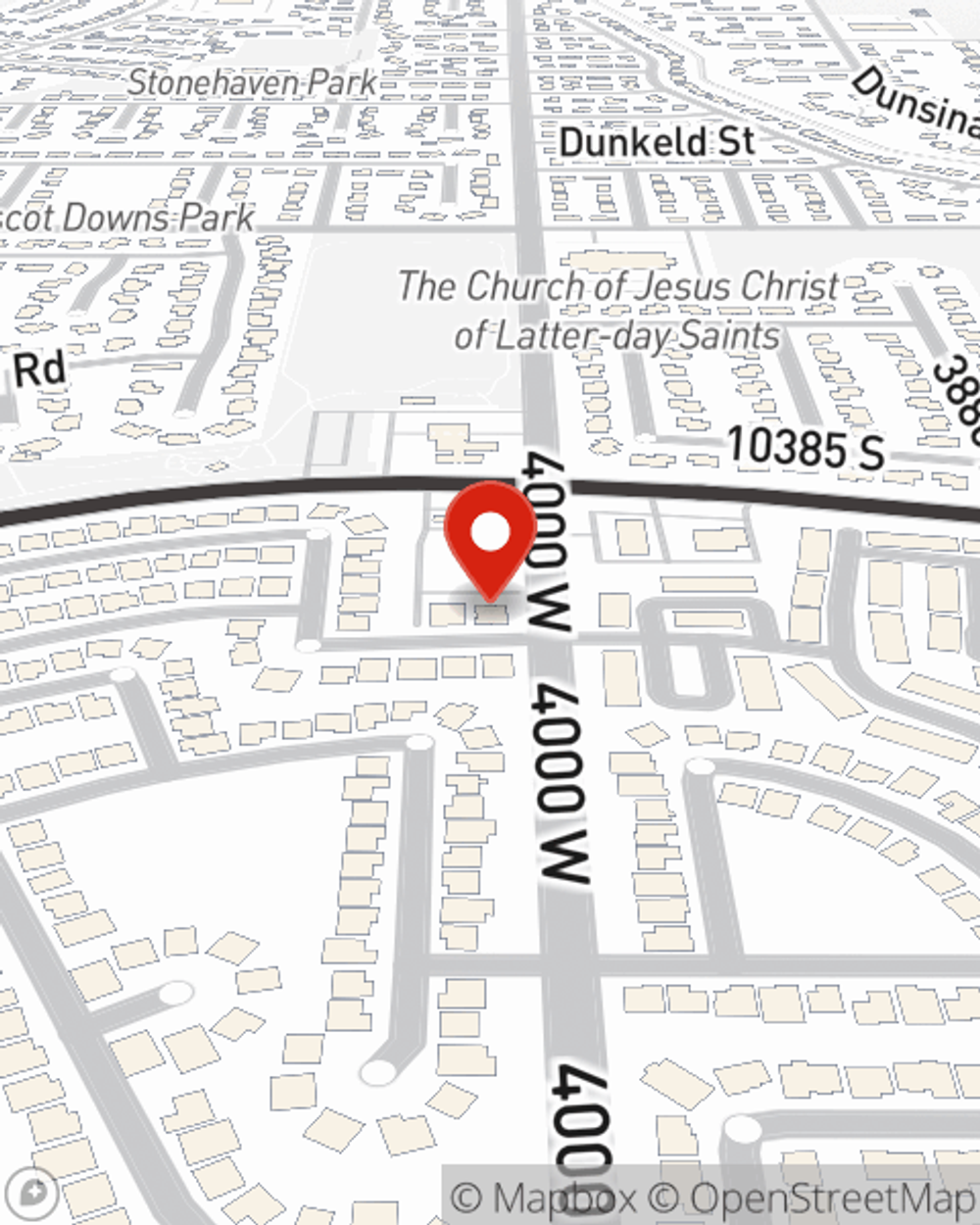

Renters Insurance in and around South Jordan

Renters of South Jordan, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your rented apartment is home. Since that is where you relax and spend time with your loved ones, it can be a wise idea to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your laptop, craft supplies, fishing rods, etc., choosing the right coverage can help protect you from the unexpected.

Renters of South Jordan, State Farm can cover you

Renting a home? Insure what you own.

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the home or space you're renting. So, if you want to protect your valuables - such as a dining room set, a guitar or a recliner - renters insurance is what you're looking for. State Farm agent Taylor Hall is dedicated to helping you evaluate your risks and protect your belongings.

Don’t let the unknown about protecting your personal belongings keep you up at night! Call or email State Farm Agent Taylor Hall today, and find out how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Taylor at (801) 285-8890 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Taylor Hall

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.